Schwab inherited ira rmd calculator

The account balance as of December 31 of the previous year. Our Schwab IRA calculators can help you get the information and answers you need to inform your financial decisions.

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

All groups and messages.

/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

. Ad Schwab Has Hassle-Free Rollover Help From Start To Finish. For Inherited IRAs it will only display the particular amount of the particular IRA Distributions that will have been obtained for the yr as Schwab may not calculate an inherited RMD regarding. Ad A Better way to access the investment advisor registered rep ecosystem.

This calculator has been updated for the. How to Calculate IRA Required Minimum Distribution With an RMD Calculator. This tool will help you estimate the annual withdrawals you may need to take.

Estimate annual minimum withdrawals you may be responsible to take from your inherited IRA using an inherited IRA RMD calculator from TD Ameritrade. Scroll over the chart below to show your estimated RMD over the next 30 years. Distributions are Required to Start When You Turn a Certain Age.

Our Schwab IRA calculators can help you get the information and answers you need to inform your financial decisions. If you are age 72 you may be subject to taking annual withdrawals known as. Ad Schwab Has Hassle-Free Rollover Help From Start To Finish.

How To Calculate RMD For Inherited IRAs. Schwab Can Help You Make A Smooth Transition. Our Schwab IRA calculators can help you get the information and answers you need to inform your financial decisions.

RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so. Reviews Trusted by Over 20000000. How to transfer property from father to son after death in odisha.

Schwab Can Help You Make A Smooth Transition. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Daily Updates - 63 million investment advisor data points covered.

Reviews Trusted by Over 20000000. A required minimum distribution RMD is the minimum amount of money that a Traditional IRA holder is required to withdraw annually once they reach the RMD age. Do not use this form for Inherited.

These amounts are often called required minimum distributions RMDs. Whether you want to transfer your RMD funds to another. This calculator is undergoing maintenance for the new IRS tables.

Compare 2022s Best Gold IRAs from Top Providers. IRA Required Minimum Distribution RMD Form. For retirement accounts inherited by a non-spouse before 2020 the proceeds can be distributed over your lifetime often referred to as stretch IRAs.

Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More. For assistance please contact 800-435-4000. Explore The Benefits Of A Rollover With Us.

Taking mandatory withdrawals over time. Compare 2022s Best Gold IRAs from Top Providers. Ad The IRS Requires You Withdraw an Annual Minimum Amount From Certain Retirement Accounts.

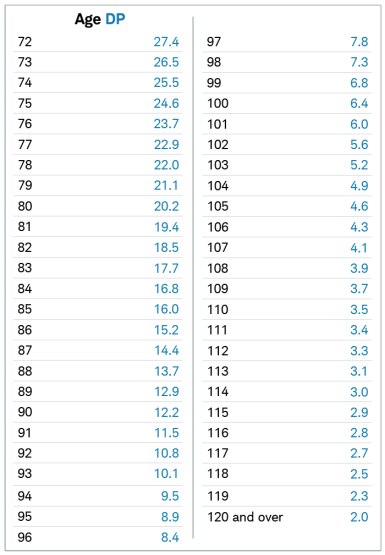

You can make a one-time also known as lump-sum withdrawal or a series of withdrawals or schedule automatic withdrawals. You can use the IRS RMD tables that are new for 2022 and calculate the RMD by hand. RMDs for Inherited IRAs are calculated based on two factors.

Complete this form if you wish to take a Required Minimum Distribution RMD from your account. You may take all the assets in the account as a lump sum distribution without facing a 10 early withdrawal penalty. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

RMD amounts depend on various factors such as the decedents age at death the year of death the type of. Distributions will be based on the oldest beneficiary. Explore The Benefits Of A Rollover With Us.

Take a lump sum distribution. TD Ameritrade Inc member.

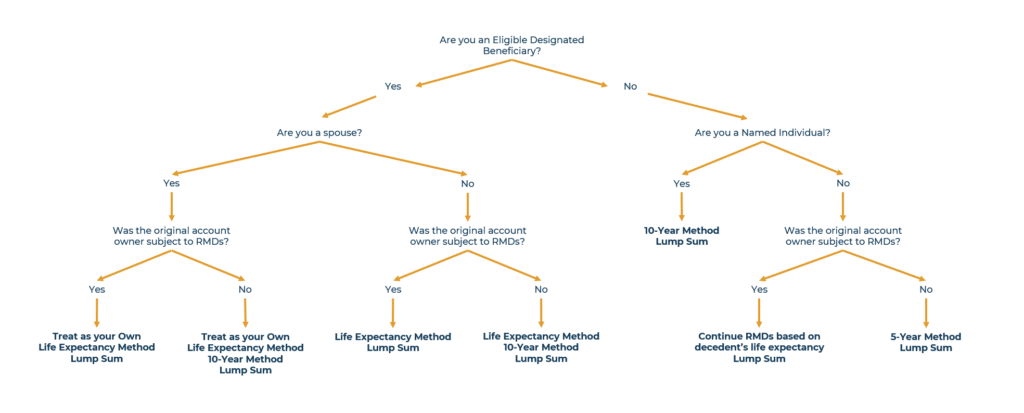

What S Your Inherited Ira Required Minimum Distribution

What To Do If You Inherit An Ira Post Secure Act Wealthspire

Where Are Those New Rmd Tables For 2022

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

Improving With Age Humbledollar Investment Portfolio Personal Finance Revocable Living Trust

How Required Minimum Distributions Work Merriman

Improving With Age Humbledollar Investment Portfolio Personal Finance Revocable Living Trust

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

The Best Retirement Plans To Build Your Nest Egg

Where Are Those New Rmd Tables For 2022

What S My Required Minimum Distribution For 2017 The Motley Fool

Top 5 Best Ira Calculators 2017 Ranking Calculate Tax Rmd Withdrawal Distribution Sep Beneficiary Advisoryhq

Improving With Age Humbledollar Investment Portfolio Personal Finance Revocable Living Trust

Required Minimum Distributions What You Should Know Retirement Plan Services

Required Minimum Distribution Rules Sensible Money

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition